Knowledge Forex Indicators

Understanding Forex indicators is important for traders who need to make informed conclusions from the forex marketplace. You have to assess indicator usefulness by examining historic facts and current market ailments.

Every single indicator serves a unique reason, whether It is pinpointing developments, measuring volatility, or signaling entry and exit points. It is vital to grasp how these indicators align with the investing psychology, as your state of mind can heavily influence your interpretations.

As an example, more than-counting on just one indicator may lead to biased choices, even though a balanced tactic fosters more rational buying and selling. By comprehension how indicators operate And just how they have an affect on your selection-earning, you may improve your strategic capabilities, in the end improving your buying and selling leads to a fancy Forex environment.

The Importance of Combining Indicators

Whilst counting on only one Forex indicator might seem simple, combining many indicators can substantially enhance your trading technique.

By leveraging indicator synergy, you are able to seize a broader sector standpoint, which cuts down the risk of Phony indicators. Every single indicator serves a unique function, and when strategically aligned, they provide a more in depth analysis of market problems.

For instance, employing trend-pursuing indicators together with momentum indicators may help ensure entry and exit points, bringing about much more informed choices. This multi-faceted approach not merely increases accuracy but additionally boosts your confidence in trades.

Eventually, combining indicators fosters a further knowledge of value movements and current market dynamics, ensuring you're much better Outfitted to navigate the complexities of Forex trading.

Types of Forex Indicators

Combining indicators opens the door to many different Forex indicators, Every single presenting unique insights into market actions.

You can experience pattern next approaches that assist you to determine and experience sector momentum, ordinarily employing shifting averages or trendlines.

On the other hand, oscillator use, like the Relative Energy Index (RSI) or Stochastic Oscillator, helps you to gauge overbought or oversold conditions.

By integrating these indicators, you could boost your buying and selling system, enabling much better timing for entries and exits.

Pattern indicators give course when oscillators signal possible reversals, developing a balanced approach.

Being familiar with the strengths and weaknesses of each and every kind empowers you to create educated buying and selling selections, maximizing your accuracy and profitability during the dynamic Forex marketplace.

Development Indicators: Figuring out Sector Route

Craze indicators play an important part in figuring out current market direction, as they help you determine the general momentum of a currency pair.

Employing pattern strains is crucial; they visually depict aid and resistance levels, enabling you to check out wherever cost actions are more likely to come about. By drawing craze lines on your charts, you are able to effectively gauge if the industry is bullish or bearish.

Relocating averages complement this Evaluation by smoothing out rate info, rendering it simpler to discover tendencies in excess of a specified period. When the cost continually stays previously mentioned a going common, it indicates a potential uptrend, Whilst a selling price down below suggests a downtrend.

Combining these resources delivers a strategic method of building knowledgeable trading selections.

Momentum Indicators: Measuring Power

Momentum indicators are critical tools for measuring the strength of rate movements from the forex industry. They help you gauge whether an asset is attaining or losing momentum, supplying critical insights for your personal trading decisions.

Crucial energy indicators such as the Relative Toughness Index (RSI) and Going Common Convergence Divergence (MACD) can reveal overbought or oversold problems, enabling you to identify likely reversals. By incorporating momentum measurement into your strategy, it is possible to superior time your entries and exits.

Give attention to divergences among rate plus your momentum indicators, as these typically sign shifts in current market sentiment. Efficiently combining these indicators with trend Assessment can improve your overall trading precision, permitting you to capitalize on lucrative chances.

Volatility Indicators: Evaluating Industry Fluctuations

Volatility indicators Enjoy a vital purpose in examining market place fluctuations and knowing cost dynamics from the forex landscape. By employing different volatility metrics, you'll be able to gauge how rate movements reply to modifying marketplace sentiment.

For illustration, resources like the Average Accurate Range (ATR) assist you determine potential breakout points, enabling you to strategize your entries and exits proficiently. Additionally, Bollinger Bands can visually represent volatility and spotlight overbought or oversold disorders.

Comprehending these indicators enables you to foresee possible value swings and adjust your investing tactics accordingly. When you mix volatility indicators with other tools, you boost your capacity to navigate unpredictable marketplaces, in the long run increasing your buying and selling accuracy and choice-earning method.

Quantity Indicators: Understanding Market place Action

Knowing current market exercise through volume indicators is important for producing informed investing conclusions. Quantity indicators mt4 reveal the energy of rate actions by analyzing quantity tendencies, helping you gauge market participation.

After you see increasing volume along with a rate rise, it typically indicates powerful obtaining interest, suggesting a potential continuation of the trend. Conversely, if selling prices rise but quantity declines, it could sign a weakening development and probable reversal.

It truly is essential to combine quantity Evaluation with other indicators for a far more complete view. By monitoring quantity developments, you could discover important levels of assistance and resistance, boosting your power to forecast current market movements efficiently.

In the end, comprehension quantity can help you navigate the complexities of forex buying and selling with higher self confidence.

Creating a Balanced Indicator Approach

A effectively-structured indicator strategy can substantially improve your trading selections, especially when combined with insights from quantity indicators.

To produce a balanced indicator tactic, give attention to efficient indicator variety. You'll want to take into account a mixture of pattern-adhering to indicators like going averages and momentum indicators such as the RSI. This combination helps you to capture value actions while examining market place strength.

In addition, system optimization is vital. Backtest your selected indicators on historical info to evaluate their effectiveness throughout different industry ailments. Change parameters and refine your technique according to these final results.

Combining Technological and Fundamental Assessment

Although technical analysis presents useful insights into value actions, integrating basic Evaluation can significantly enhance your investing technique.

By thinking about financial indicators, like GDP progress and work charges, it is possible to gauge the general wellness of economies affecting forex pairs. This facts informs your knowledge of industry sentiment, which can be very important for anticipating value shifts.

As an example, if solid employment figures coincide with a bullish technological sign, your assurance in the trade's potential results raises. Conversely, weak economic knowledge can invalidate a technological setup.

Combining these analyses means that you can not just react to price styles but will also understand the fundamental forces driving them, ultimately bringing about a lot more knowledgeable, strategic buying and selling decisions.

Backtesting Your Indicator Mixtures

Before you decide to trading using your picked indicators, It truly is essential to backtest your combinations to assess their usefulness.

Begin by using various backtesting procedures, for instance historic details Assessment and simulation, To guage how your indicators conduct underneath various industry conditions. This method aids you recognize patterns and refine your method.

Target key functionality metrics like get charge, financial gain aspect, and drawdown to gauge the trustworthiness of your mixtures. By examining these metrics, you are able to identify When your indicators work synergistically or if adjustments are wanted.

Backtesting not merely boosts your assurance but in addition improves your determination-creating method, making sure you technique the market having a very well-examined system.

Frequent Mistakes in order to avoid When Combining Indicators

When combining indicators, it's vital to stay away from overcomplicating your strategy, as doing this may result in confusion and conflicting indicators.

Just one prevalent error is indicator redundancy, in which you use several indicators that provide a similar info. This not simply clutters your Examination but may also mask vital signals.

On top of that, be cautious of around optimization pitfalls; tweaking your indicators to fit past data can develop a Fake perception of protection. As a substitute, center on a couple of complementary indicators that enhance your strategy with no mind-boggling it.

Preserve clarity in your method, making sure each indicator serves a distinct function. By staying away from these issues, you'll cultivate a more practical and streamlined trading method that enhances your selection-earning system.

Authentic-Existence Examples of Thriving Indicator Combinations

Thriving buying and selling techniques typically hinge about the productive combination of indicators that complement one another as an alternative to muddle the Examination. As an illustration, pairing the Shifting Typical Convergence Divergence (MACD) Along with the Relative Power Index (RSI) may result in prosperous trades. The MACD identifies momentum shifts when the RSI reveals overbought or oversold conditions, building indicator synergy.

One more effective mix is definitely the Bollinger Bands and Stochastic Oscillator. Bollinger Bands assist you see volatility, whilst the Stochastic Oscillator implies opportunity reversal factors. Jointly, they provide a clear entry and exit system, enhancing your possibilities of thriving trades.

Conclusion

Within the dynamic environment of Forex buying and selling, combining indicators is like weaving a safety net beneath your conclusions. By strategically pairing trend and momentum indicators, you not merely improve your industry Perception but also bolster your confidence in trades. Try to remember, It is important to backtest your procedures and avoid widespread pitfalls to make certain that Every single indicator plays its exceptional job. With the proper combos as part of your toolkit, you happen to be far better Outfitted to navigate the ever-transforming Forex landscape.

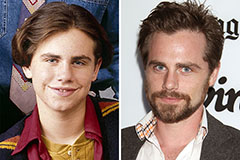

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Loni Anderson Then & Now!

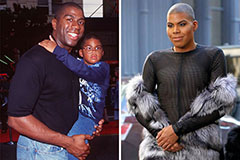

Loni Anderson Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!